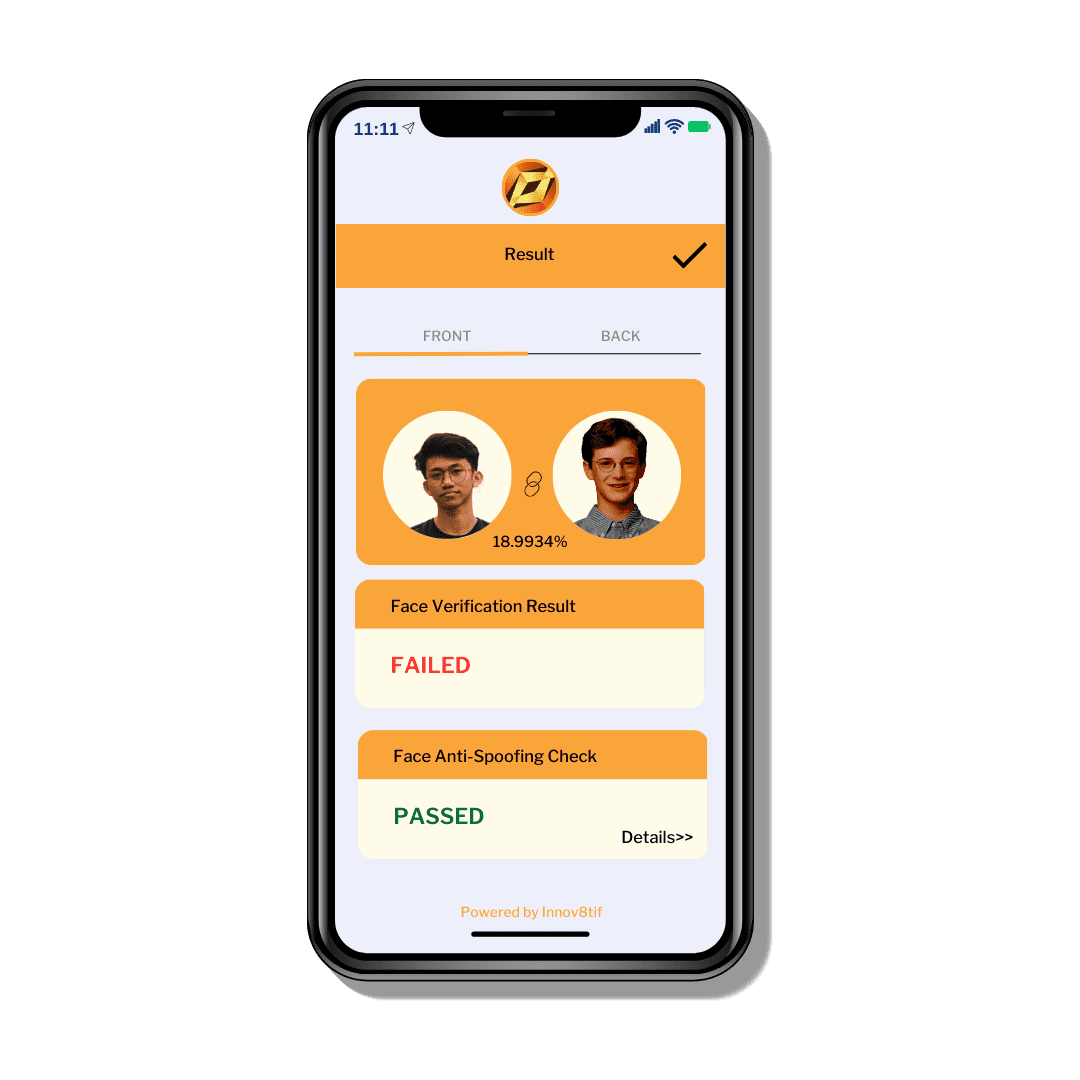

Streamlining customer journeys with eKYC & ID Verification

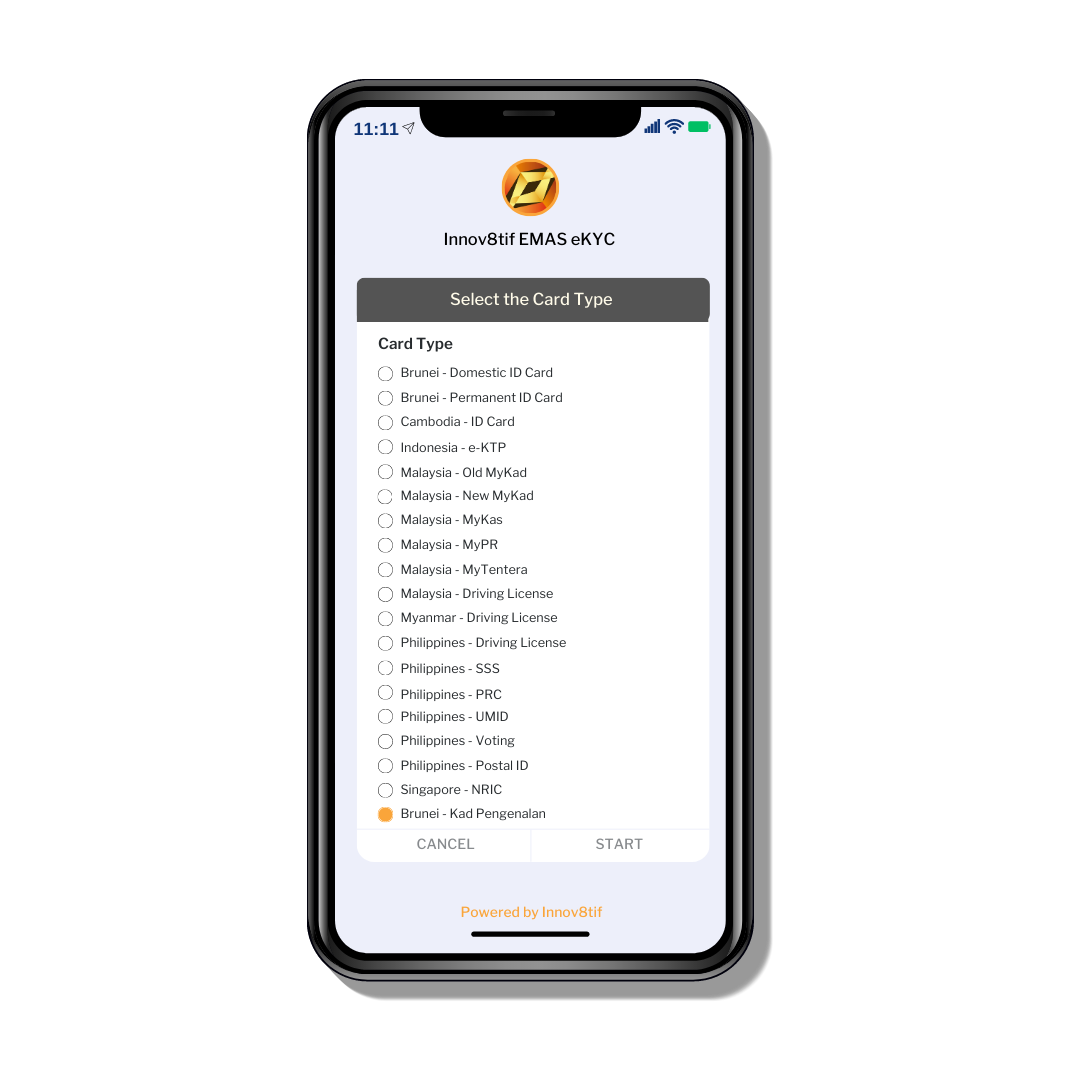

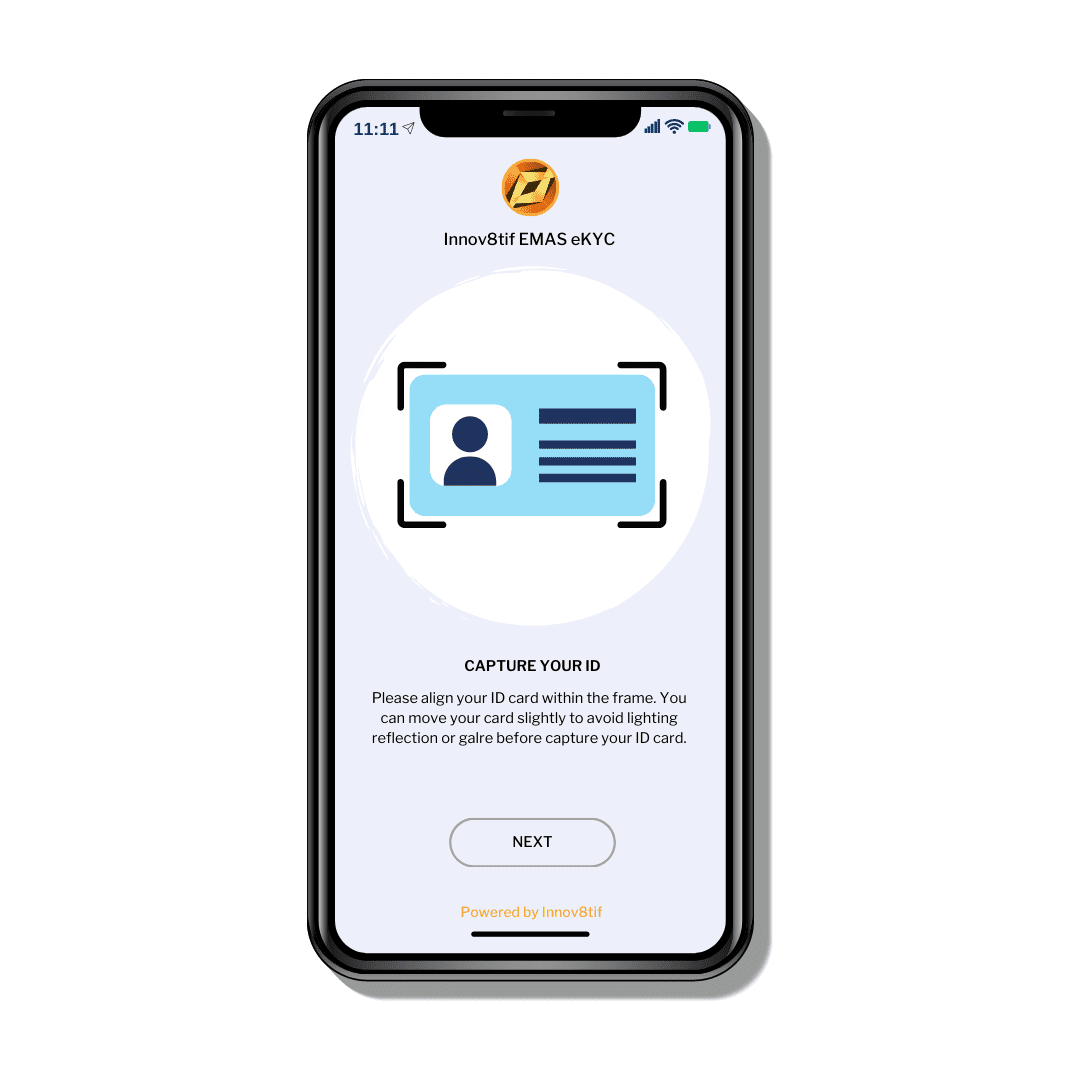

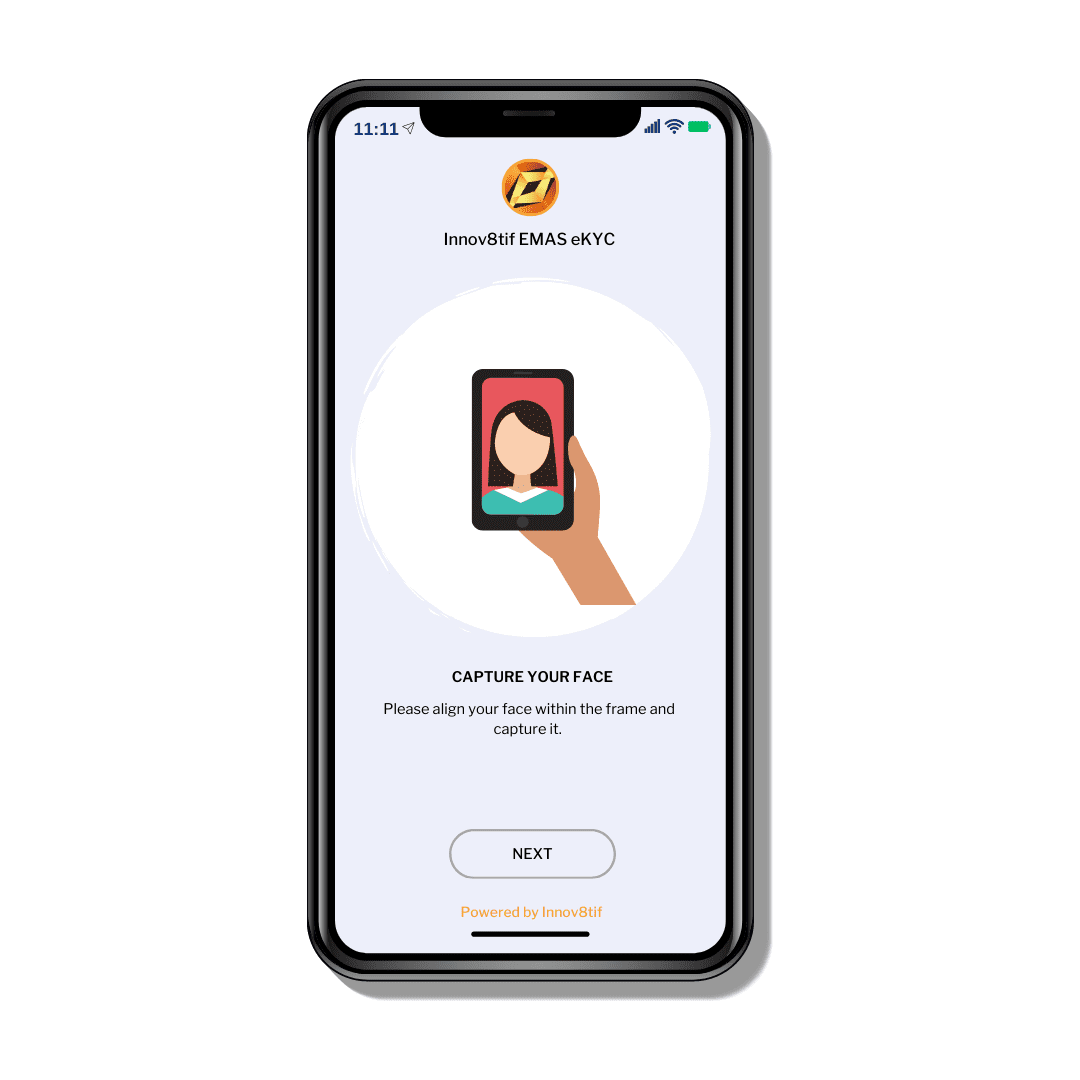

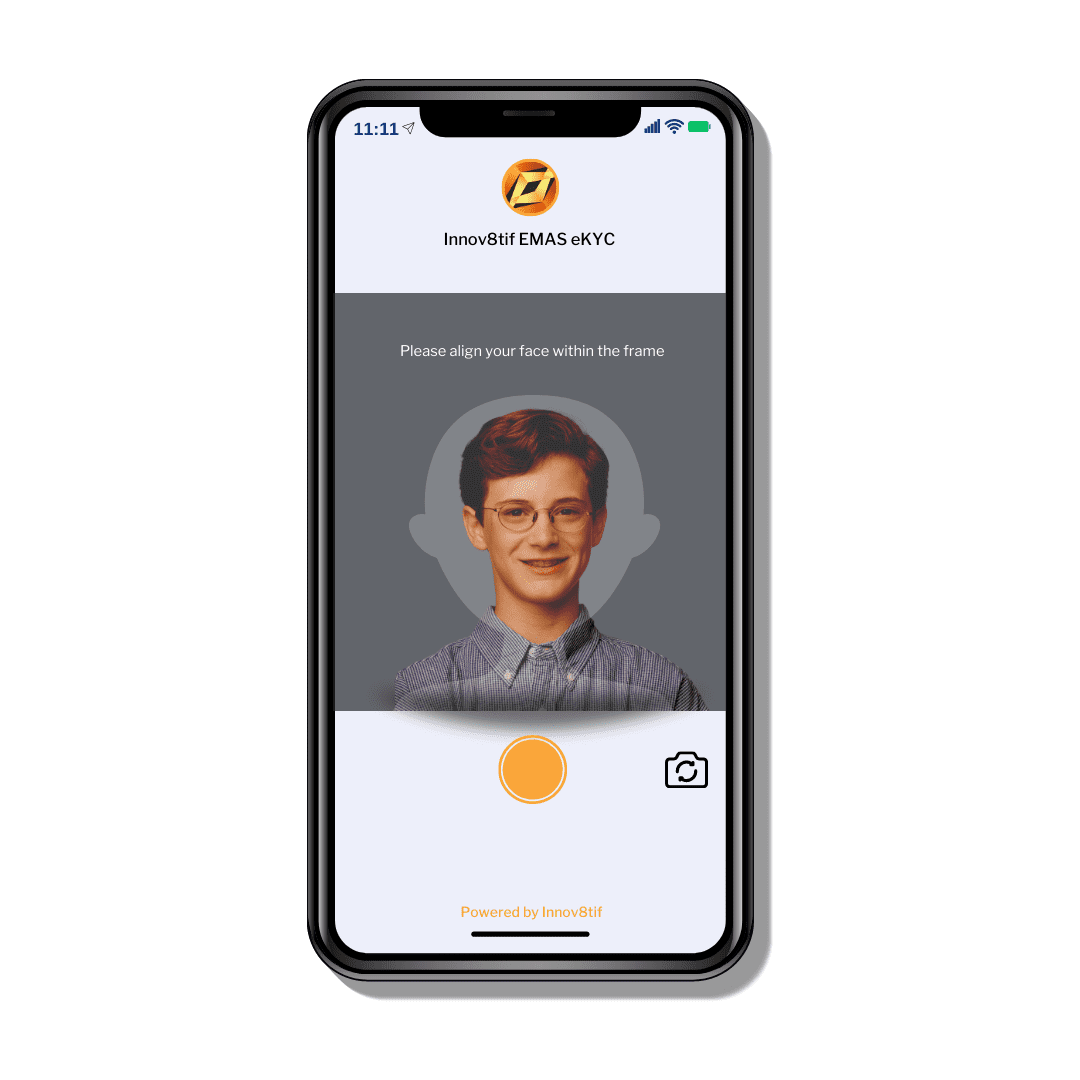

EMAS eKYC is an integrated digital ID verification technology that streamlines e-KYC customer onboarding journey for your digital customer touch points. We are here to help you mitigate identity forgery risks by securely validating customer's identity documents and facial biometrics securely.

How It Works?

Customer We've Helped - Banking

BIBD is the only bank in Brunei that serves all segments within the retail banking market. The implementation of EMAS eKYC during the sign-up process can be completed in just 2 minutes. Customers now can open a new bank account and verify their identity digitally. This solution definitely will make sure the customer onboard to their system is a legitimate customer only.

Bank Islam Brunei Darussalam, Brunei.